All Categories

Featured

Table of Contents

There is no payment if the policy expires prior to your fatality or you live beyond the plan term. You might be able to restore a term plan at expiration, however the premiums will certainly be recalculated based on your age at the time of revival.

At age 50, the premium would rise to $67 a month. Term Life Insurance Fees thirty years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in excellent health and wellness. On the other hand, here's a check out rates for a $100,000 entire life policy (which is a sort of permanent policy, meaning it lasts your life time and includes cash money worth).

Interest rates, the financials of the insurance policy business, and state regulations can also influence premiums. When you take into consideration the quantity of coverage you can get for your costs dollars, term life insurance policy has a tendency to be the least pricey life insurance.

He buys a 10-year, $500,000 term life insurance coverage plan with a premium of $50 per month. If George dies within the 10-year term, the plan will pay George's recipient $500,000.

If George is identified with a terminal ailment during the first policy term, he probably will not be eligible to restore the policy when it expires. Some policies provide assured re-insurability (without proof of insurability), however such functions come with a greater price. There are several sorts of term life insurance policy.

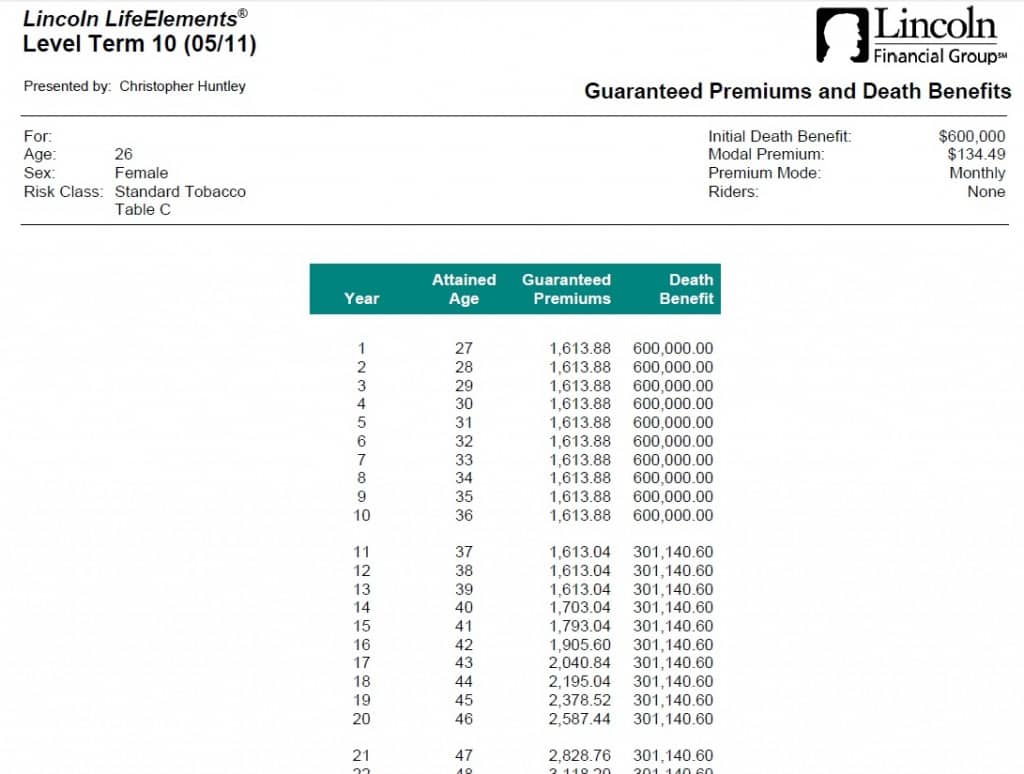

The majority of term life insurance coverage has a degree premium, and it's the type we've been referring to in most of this short article.

Flexible Which Of These Is Not An Advantage Of Term Life Insurance

Term life insurance policy is appealing to youngsters with kids. Moms and dads can get substantial insurance coverage for an affordable, and if the insured passes away while the plan holds, the family can depend on the survivor benefit to change lost earnings. These plans are also fit for individuals with growing families.

Term life plans are optimal for individuals that want significant insurance coverage at a low cost. Individuals that have whole life insurance pay much more in premiums for much less protection but have the safety of understanding they are protected for life.

The conversion motorcyclist need to enable you to transform to any kind of irreversible plan the insurance provider supplies without restrictions. The primary attributes of the rider are maintaining the initial wellness score of the term policy upon conversion (also if you later have wellness problems or become uninsurable) and making a decision when and exactly how much of the insurance coverage to convert.

Of course, general premiums will certainly enhance dramatically given that entire life insurance coverage is more costly than term life insurance. Medical conditions that create throughout the term life period can not trigger costs to be boosted.

Term life insurance coverage is a fairly affordable way to supply a lump sum to your dependents if something occurs to you. It can be a great alternative if you are young and healthy and balanced and sustain a family. Whole life insurance coverage features substantially greater monthly premiums. It is meant to give protection for as lengthy as you live.

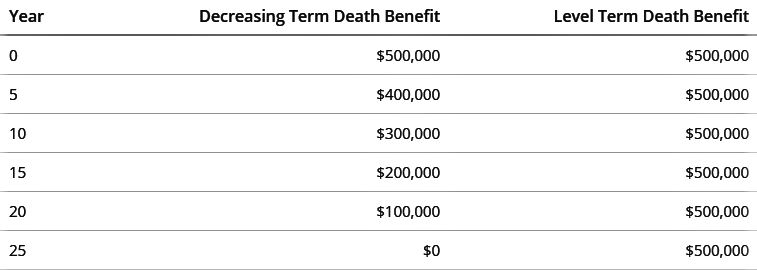

Effective Decreasing Term Life Insurance

It depends upon their age. Insurance firms set a maximum age limit for term life insurance plans. This is generally 80 to 90 years old however might be higher or reduced relying on the business. The costs additionally rises with age, so a person aged 60 or 70 will pay significantly greater than somebody decades younger.

Term life is rather similar to car insurance coverage. It's statistically not likely that you'll need it, and the costs are cash down the tubes if you don't. But if the worst takes place, your family will obtain the benefits.

One of the most prominent type is now 20-year term. A lot of companies will certainly not offer term insurance policy to an applicant for a term that ends previous his/her 80th birthday. If a plan is "sustainable," that indicates it proceeds effective for an added term or terms, up to a specified age, also if the wellness of the insured (or other aspects) would certainly trigger him or her to be denied if he or she got a new life insurance policy plan.

Costs for 5-year eco-friendly term can be degree for 5 years, after that to a brand-new price mirroring the new age of the guaranteed, and so on every 5 years. Some longer term plans will certainly guarantee that the premium will not enhance throughout the term; others do not make that guarantee, making it possible for the insurance provider to increase the price during the policy's term.

This suggests that the policy's owner deserves to transform it into a long-term type of life insurance policy without extra evidence of insurability. In the majority of sorts of term insurance coverage, including homeowners and auto insurance policy, if you have not had a claim under the plan by the time it runs out, you get no refund of the premium.

Expert A Renewable Term Life Insurance Policy Can Be Renewed

Some term life insurance policy customers have been miserable at this outcome, so some insurance companies have actually developed term life with a "return of premium" feature. guaranteed issue term life insurance. The premiums for the insurance with this feature are commonly substantially greater than for policies without it, and they usually need that you maintain the plan active to its term or else you surrender the return of costs advantage

Level term life insurance premiums and fatality benefits continue to be consistent throughout the plan term. Level term life insurance policy is typically a lot more budget friendly as it doesn't build money value.

Annual Renewable Term Life Insurance

While the names typically are used interchangeably, level term insurance coverage has some essential distinctions: the premium and survivor benefit stay the exact same throughout of insurance coverage. Degree term is a life insurance plan where the life insurance costs and survivor benefit remain the same for the duration of protection.

Table of Contents

Latest Posts

The Best Funeral Policy

Best Funeral Plan For Over 50

Funeral Insurance Brokers

More

Latest Posts

The Best Funeral Policy

Best Funeral Plan For Over 50

Funeral Insurance Brokers